How To Build Sales Pipeline: A Practical Guide That Converts

By Mriganka Bhuyan

•Founder at Munch

Alright, let's ditch the robotic fluff and talk about what a sales pipeline really is.

Building a sales pipeline isn't just about creating a fancy spreadsheet. It's about engineering a repeatable, predictable system for cranking out revenue. We're talking about a step-by-step process: figuring out who you actually want to sell to, finding them, nurturing them through a logical journey, and obsessively measuring everything along the way.

Think of it as building a revenue engine, not just a list.

Your Sales Pipeline Is a Revenue Engine, Not a Wish List

Can we be honest for a second? Most sales pipelines are just glorified wish lists. They're bloated CRM dashboards packed with "deals" that have a snowball's chance in hell of ever closing. People treat them like a weather forecast, a hopeful guess at what the future might hold.

That's a huge mistake.

Confusing your pipeline with your forecast is like mistaking the blueprint for the finished skyscraper. The forecast is the pretty 3D rendering of what you hope it will look like, but the pipeline is the detailed plan showing every single girder, wire, and bolt needed to actually build the damn thing.

A pipeline is a process, not a prediction. It’s an active, manageable system that gives you a real-time health check on your future business. A forecast is just the output you get from that system.

The Blueprint Before the Build

Before we start pouring the concrete, we need to know exactly what we're constructing. A killer sales pipeline is a series of clearly defined stages a prospect moves through, from a curious stranger to a happy, paying customer. Each stage has strict entry and exit rules, making sure deals only move forward when they're truly ready.

This structured approach has never been more critical. The buying game has completely changed. Buyers do their own digging now, getting way down the road in their decision-making process before they ever want to talk to a salesperson.

In fact, Gartner predicts that by 2025, a whopping 80% of B2B sales interactions will happen on digital channels. This seismic shift means your pipeline has to be built to meet people where they are, with the right message at the right moment. You can dig into more B2B sales benchmarks on trykondo.com.

A well-oiled pipeline gives you some serious firepower:

-

Predictable Revenue: It turns wild guesses into data-driven science, which makes the finance team love you.

-

Team Efficiency: Your reps stop chasing ghosts and focus their precious time on deals that can actually close.

-

Scalable Growth: You get a repeatable playbook that you can scale up as your company explodes, without everything catching fire.

To give you a bird's-eye view of where we're headed, let's lay out the entire journey. Think of this as the master blueprint we'll be breaking down piece by piece.

The 7 Stages of a Modern Sales Pipeline

Here's a high-level look at the full process. We're going from "Who are these people?" all the way to "Welcome aboard!" This table outlines the core purpose and the key salesperson activity at every single step of the journey.

| Stage Number | Stage Name | Primary Goal | Key SDR/BDR Activity |

|---|---|---|---|

| 1 | Targeting & Sourcing | Identify and find best-fit accounts and contacts. | Building lead lists, researching accounts (ICP). |

| 2 | Prospecting & Outreach | Make initial contact and generate interest. | Cold calls, email sequences, LinkedIn messaging. |

| 3 | Lead Qualification | Determine if the prospect has a real need and is a good fit. | Discovery calls, BANT/MEDDIC qualification. |

| 4 | Meeting Scheduled | Secure a formal meeting or demo for an Account Executive. | Booking the meeting, initial prep. |

| 5 | Handoff & Demo | Transition the qualified lead smoothly to the closing team. | Internal briefing, AE takes over for demo/presentation. |

| 6 | Evaluation & Proposal | The prospect is actively considering your solution. | AE follows up, sends proposal, negotiates terms. |

| 7 | Closed Won / Closed Lost | Final decision is made. | Contract signed or deal marked as lost for feedback. |

This is our map. Now, let's dive into the first stage and start building this engine from the ground up.

First Things First: Who Are You Actually Selling To?

Jumping into pipeline building without a rock-solid Ideal Customer Profile (ICP) is like setting sail without a map. Sure, you're moving, but you're probably heading straight for the rocks. Before a single cold call is made or one email is sent, you absolutely have to know precisely who you're targeting.

An ICP isn't some vague notion like "we sell to software companies." That’s a rookie mistake. A real, actionable ICP is a hyper-specific blueprint of your perfect customer. It’s the secret sauce that lets you laser-focus your team’s precious time and energy on the accounts most likely to buy, stay, and rave about you.

Go Deeper Than The Obvious Details

Basic firmographics like company size, industry, and geography are table stakes. That's just the starting line. The real magic happens when you dig into the nuanced, hidden patterns that your best customers share. Put on your detective hat and start looking for clues.

A great place to start is with your top 10 customers. You know the ones: they renewed without a fight, they’re getting massive value, and they’re a joy to work with. Now, dissect what they have in common.

-

What’s in their tech stack? Do they all use Salesforce? Are they all hosted on AWS? Maybe they use a specific marketing automation tool that your product integrates with perfectly.

-

What were the buying triggers? Did they just raise a Series B round of funding? Did a new VP of Sales just start? These events often unlock new budgets and a desire for change.

-

What was their behavior? Did a bunch of them download your "State of the Industry" report right before signing up? Did they attend the same webinar?

This exercise turns a fuzzy target into a crystal-clear one. You go from "tech companies" to something like: "Series B fintech companies between 50-200 employees, actively hiring SDRs, using Salesforce, and who just brought on a new Head of Revenue in the last 90 days." Now that's a target you can sink your teeth into.

Finding Leads Who Actually Match Your Profile

With your ICP locked and loaded, the hunt begins. This is where so many sales teams stumble, falling for the siren song of cheap, dusty lead lists that have been passed around more than a hot potato. Just don't.

Modern lead sourcing is about precision, not volume. You need fresh, accurate data that tells you what’s happening in your target accounts right now. This is the absolute cornerstone of any effective outbound lead generation strategy, ensuring your pipeline is filled with gold from the get-go.

Your goal isn't to find everyone. It's to find the right one, right now. Chasing thousands of bad-fit leads is the fastest way to burn out your team and tank morale.

The best way to do this is by focusing on real-time buying signals. These are the flares in the night sky that signal a company is ready, willing, and able to buy.

Here are a few high-intent signals you should be tracking relentlessly:

-

Funding Announcements: New cash means new priorities and new budgets for tools that drive growth.

-

Key Executive Hires: A new leader, especially in a C-suite or VP role, almost always re-evaluates their department's tech stack.

-

Technology Adoption: A company just installed a new CRM? They're clearly in "improvement mode" and are probably looking for other tools to complement it.

-

Job Postings: If a company is suddenly hiring a dozen new salespeople, you can bet they'll need tools to make them successful.

Pro Tip: You can use Munch to build your prospect and lead list based on intent signals and other filters.

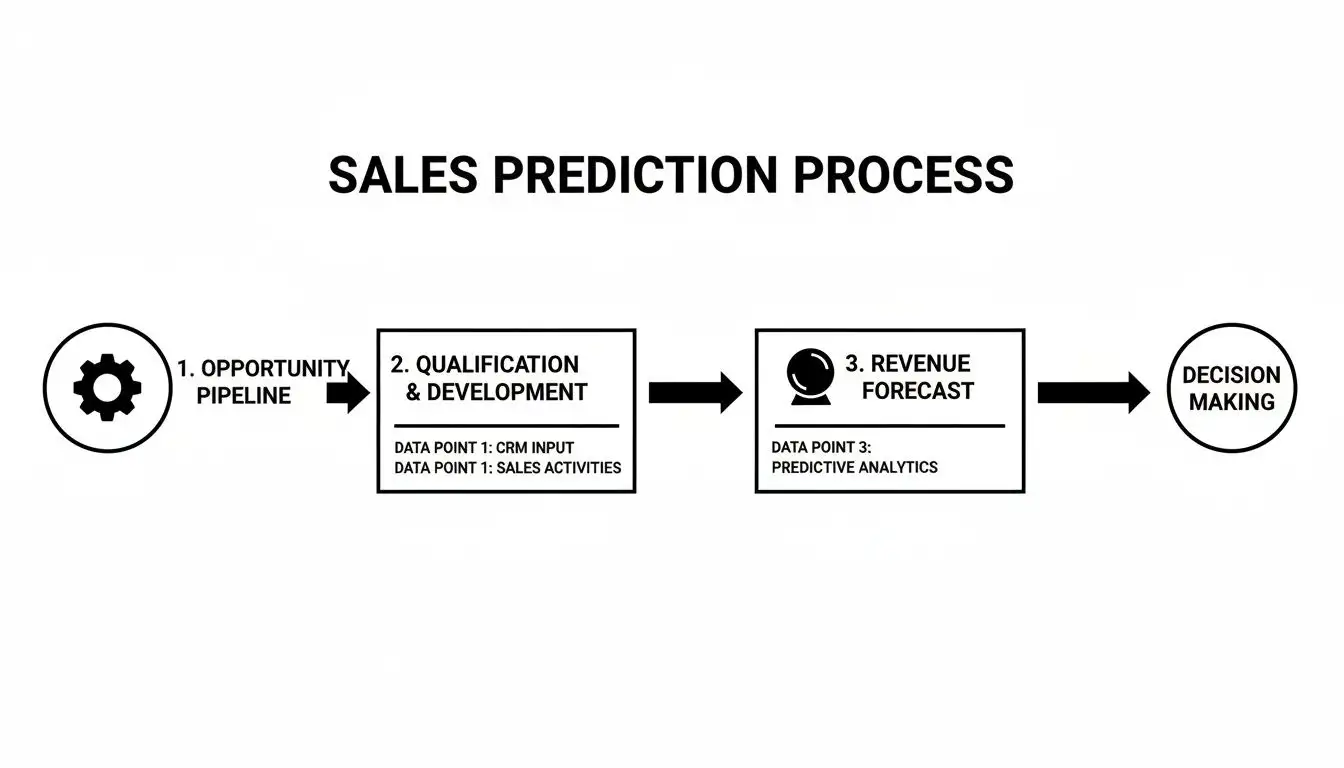

Getting this right has a massive downstream effect on your ability to actually predict revenue, as you can see below.

A pipeline stuffed with random, non-ICP leads is a recipe for a garbage forecast. But a pipeline built with precision leads to predictable, reliable revenue. It’s the difference between guessing and knowing.

Qualify Leads So Your Team Talks to Actual Buyers

Let's be real. A pipeline full of leads is great, but a pipeline full of prospects who have no budget, no authority, and no real need for what you’re selling? That's just a time-suck. It’s like casting a reality show with people who swear they're "here for the right reasons," a noble thought that usually ends in disappointment.

The magic isn't just in finding leads; it's in qualifying them. This is the art of separating the window shoppers from the serious buyers. It’s how you make sure your sales team spends their precious energy on conversations that can actually lead to a signed contract.

A Modern Twist on a Classic Framework

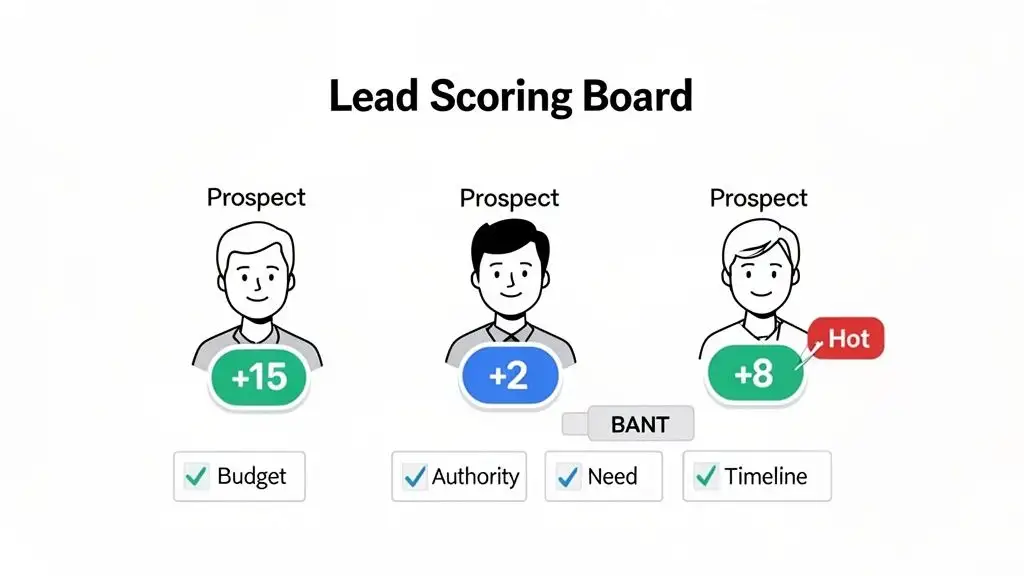

A great place to start is the classic BANT framework. Think of it as the Salt-N-Pepa of sales methodologies, a timeless banger that still gets the job done. It stands for:

-

Budget: Can they actually afford your solution?

-

Authority: Are you talking to the decision-maker, or someone who needs sign-off from their boss, their boss’s boss, and the company mascot?

-

Need: Do they have a real, painful problem that your product solves?

-

Timeline: Is this a "we need this yesterday" situation or a "maybe next fiscal year" fantasy?

But in today’s world, BANT alone isn't quite enough. You need to layer it with modern buying intent signals. This is where lead scoring comes in, turning qualification from a gut feeling into a simple, points-based game. The whole point is to assign value to actions that show a prospect is moving from "just browsing" to "shut up and take my money!"

Think of lead scoring as your pipeline’s bouncer. It checks IDs and makes sure only the VIPs (Very Interested Prospects) get through the velvet rope to your sales team. This simple system keeps your reps from getting stuck in conversations that are going absolutely nowhere.

Building Your Lead Scoring System

You don’t need a data scientist from NASA to cook up a useful lead scoring model. Just start with a simple set of rules that assign points based on a prospect's behavior and profile. The higher the score, the hotter the lead.

Here’s a practical example of what this could look like:

High-Intent Actions (High Scores):

-

Requests a demo or pricing info: +25 points

-

Visits your pricing page multiple times: +15 points

-

Downloads a late-stage case study: +10 points

Mid-Intent Actions (Medium Scores):

-

Attends a live webinar: +8 points

-

Subscribes to your blog or newsletter: +5 points

-

Opens and clicks a link in an email: +3 points

Don’t get hung up on these exact numbers. The key is to define what actions really matter for your business and assign points that make sense. Once you have a system, you can set a threshold. For example, any lead that hits 50 points gets automatically flagged as a Sales Qualified Lead (SQL) and is fast-tracked to a sales rep.

This isn’t just about making things run smoothly; it's about survival. Pipeline conversion benchmarks show a massive drop-off between stages. While an average team might see 12-18% of marketing leads convert to sales qualified, top performers using smart scoring can push that number way up. This ensures the handoff from marketing to sales is actually valuable. You can check out more data on B2B sales pipeline conversion rates with Marketjoy.

Getting this right is absolutely crucial. For a deeper dive into setting up your own system, check out our guide on lead scoring best practices to learn how to create rules that actually work.

Design Outreach Sequences That Actually Get Replies

Alright, you’ve got a list of qualified leads. Now for the fun part: actually talking to them. But let’s be honest, if your outreach reads like a fax machine trying to write poetry, you're going to get ignored, deleted, or worse, publicly shamed on LinkedIn.

The goal here isn't to just blast a thousand people with the same boring template. It's to build a smart, multi-channel sequence that feels personal and actually adds value at every single step. This is how you create a pipeline full of engaged prospects, not just digital crickets.

Think of it this way: a great sequence is a mix of art and science. You're combining different channels like email, LinkedIn, maybe even an old-fashioned phone call, all spaced out over a couple of weeks. It’s no secret that it takes more than 8 touches to get a deal across the line, yet a wild 44% of salespeople give up after just one try. That’s a huge opportunity you can jump on with a persistent, well-designed plan.

The Anatomy of a High-Performing Sequence

First things first: kill the "just checking in" emails. Forever. Every single touchpoint needs a purpose. It should either offer a fresh piece of value, provide a new angle, or gently nudge the conversation forward. You want to be a welcome interruption, not an annoying pest.

A solid sequence strikes a perfect balance between automation and real, human personalization. Sure, you can automate the timing and delivery, but the message itself has to feel like it was written specifically for the person on the receiving end. This is your chance to connect the dots between their problem and your solution in a way that actually hits home.

A great outreach sequence is like a good conversation. It doesn't start with a sales pitch. It starts by showing you've done your homework, understand their world, and have something genuinely useful to share.

A 10-Touch, 14-Day Sequence You Can Steal

Here’s a practical, multi-channel sequence you can rip off and adapt. Notice how it escalates gently and mixes things up to stay top-of-mind without being obnoxious. For a deeper dive into the strategy, exploring various sales cadence best practices can give you even more frameworks to test out.

The "Value-First" Multi-Channel Sequence:

-

Day 1 (AM): Hyper-Personalized Email. Kick things off by referencing a specific trigger event. Something like: "Saw your company just raised a Series B to expand the sales team, congrats! As you scale, keeping new reps productive is a huge challenge. Thought this case study on how we helped [Similar Company] cut ramp time by 30% might be useful."

-

Day 1 (PM): LinkedIn Connection Request. Don't just hit the button. Add a note: "Hi [Name], loved your recent post on [Topic]. Following up on my email with a resource for scaling sales teams. Hope to connect."

-

Day 3: Follow-Up Email. Add another layer of value. "Hey [Name], hope that case study was helpful. Many leaders I speak with are also focused on improving forecast accuracy. Here’s a short article on three common mistakes to avoid. Any of this resonating?"

-

Day 5: LinkedIn Engagement. This is a soft touch. Like or comment on one of their recent posts. It’s a low-effort way to stay on their radar. No pitch, just genuine engagement.

-

Day 7: Call Attempt 1. If you’ve got their number, give them a ring. Don't be weird about it. "Hi [Name], this is [Your Name] from [Your Company]. I sent over a couple of resources about scaling sales teams and just wanted to briefly introduce myself. Is now a bad time?"

-

Day 9: Email with a "Pattern Interrupt." Time to switch it up. Try a different angle, maybe use a funny (but relevant) GIF or ask a thought-provoking question. "Quick question, [Name], what's the one thing you'd change about your current pipeline if you had a magic wand?"

-

Day 11: LinkedIn Message. Slide into their DMs (professionally, of course). "Hey [Name], just trying to connect. Are you the right person to chat with about sales productivity, or would someone else on your team be a better fit?"

-

Day 12: Call Attempt 2. Try again, maybe at a different time of day. Reference your previous touches so it doesn't feel completely random.

-

Day 14 (AM): The "Breakup" Email. This one has a surprisingly high reply rate. Keep it professional and polite. "Hi [Name], I've reached out a few times without success. It seems like now isn't the right time to connect about improving sales productivity. I won't reach out again, but please let me know if that changes. All the best."

-

Day 14 (PM): Remove from Sequence. If you still haven’t heard back, respect their inbox and move on.

This structure is just a framework. The real magic happens when you use the right tools to personalize these messages at scale, making sure every touch feels authentic and relevant.

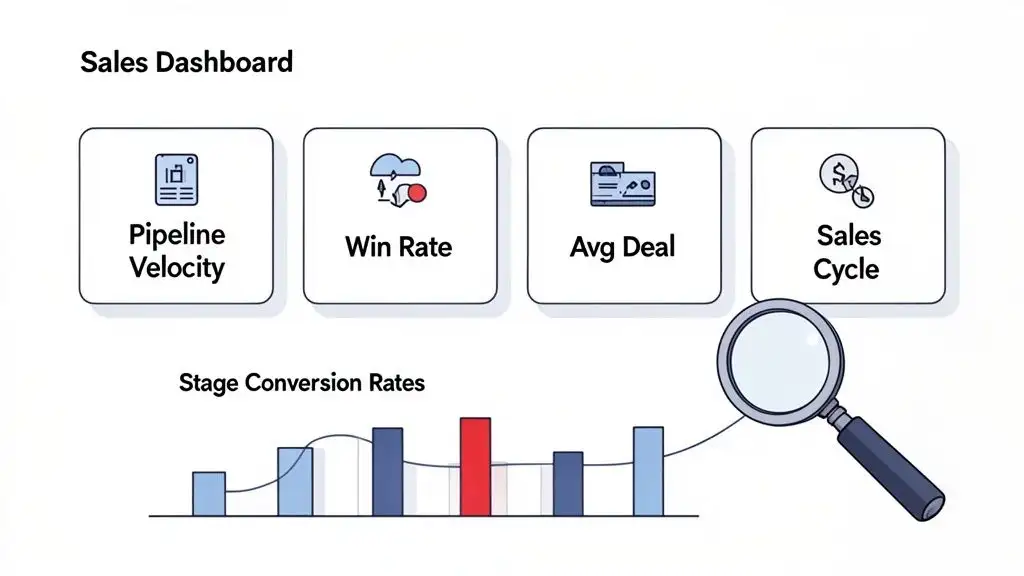

Measure What Matters With Pipeline KPIs and Dashboards

Building a sales pipeline without the right KPIs is like flying a plane blind. You feel the engine running, but you have no idea if you're gaining altitude or about to nosedive into a mountain. You need a cockpit, a dashboard with gauges that tell you exactly what's going on.

Let's be clear: we're not talking about vanity metrics. "Emails sent" or "dials made" are just noise. They tell you your team is busy, but busyness doesn't pay the bills. We need to track the numbers that actually move the needle on revenue.

The Core Metrics That Actually Drive Revenue

To get a real pulse on your pipeline's health, you only need to obsess over a handful of core metrics. These KPIs are interconnected; they paint a complete picture that helps you spot leaks, find coaching moments, and forecast with some degree of confidence.

Here are the big four you can't ignore:

-

Average Deal Size: The most basic of the bunch. Just take the total value of your closed-won deals and divide it by the number of deals. This tells you where the money is really coming from.

-

Win Rate (or Close Rate): This is your team's batting average, the percentage of opportunities that actually turn into paying customers. If this number is low, something's broken in your qualification or sales process.

-

Sales Cycle Length: How long does it take to get from "hello" to a signed contract? This is your average time to close, usually measured in days. A sales cycle that keeps stretching longer and longer is a major red flag.

-

Pipeline Velocity: This is the big one, the master metric. It’s the speedometer for your sales engine, telling you how much revenue your pipeline is spitting out every single day.

Tracking these numbers gives you diagnostic power. Is your win rate tanking? Maybe your team needs to get better at handling objections. Is the sales cycle dragging on? Maybe a new competitor is throwing a wrench in your deals. You can't fix what you can't see.

How to Calculate Your Pipeline Velocity

Pipeline velocity is easily the most critical health metric for your entire sales operation. It rolls up the other three metrics into one powerful number that tells you how much cash you can expect to close from your current pipeline, on any given day.

The formula looks a little scary, but I promise it’s easier than building that IKEA bookshelf sitting in your garage.

Pipeline Velocity = (Number of Opportunities x Average Deal Size x Win Rate) / Sales Cycle Length (in days)

Let's break it down with a real-world example. Say your team is working with:

-

100 qualified opportunities in the pipe.

-

An average deal size of $5,000.

-

A historic win rate of 25% (or 0.25).

-

An average sales cycle of 60 days.

Plug it in: (100 x $5,000 x 0.25) / 60 = $2,083

Boom. Your pipeline is generating $2,083 in expected revenue every single day. Now you have a baseline. The game is to make that number go up by pulling one of the four levers: get more opportunities, land bigger deals, improve your win rate, or shorten that sales cycle.

Build a Dashboard That Actually Tells You Something

A dashboard shouldn't be a data graveyard where numbers go to die. It needs to be your command center, giving you an immediate, at-a-glance view of your pipeline's health. The whole point is to turn raw numbers into "aha!" moments.

A solid dashboard visualizes a few key things. First, track your pipeline velocity over time. Is the trend line heading up and to the right? Or is it starting to droop?

Next, you need to map out your stage-by-stage conversion rates. This is how you find the leaks. For example, if 80% of deals cruise from "Discovery" to "Demo," but only 20% ever make it from "Demo" to "Proposal," you've just found a massive bottleneck. That tells you your demos are falling flat or your reps aren't locking in clear next steps. For some interesting parallels on spotting behavioral patterns, check out our guide on how to track website visitors.

A stagnant pipeline is a silent killer of growth, but daily and weekly metric tracking is the antidote. And a lot of companies are feeling the pain: a whopping 74% of marketers say sales cycles are getting longer. By keeping a close eye on your pipeline's vitals, you can pivot fast instead of getting left in the dust.

Got Questions About Building a Sales Pipeline? We've Got Answers.

Alright, let's tackle some of the head-scratchers that pop up when you're building a sales pipeline from scratch. Even seasoned pros get stuck on these. Think of it less like assembling a Death Star and more like building with LEGOs; there are a few core principles, but endless ways to put the pieces together.

Here are some of the most common questions I hear, with straight-shooting answers to get you on the right track.

How Many Stages Should a B2B Sales Pipeline Have?

There's no single magic number here. But for most B2B outfits, 5 to 7 stages is the sweet spot. It’s like a movie plot; you need enough scenes to tell the story, but not so many that the audience gets bored and starts checking their phone.

A solid, no-nonsense structure usually looks something like this:

-

Lead Generation

-

Qualification

-

Discovery Meeting

-

Proposal

-

Negotiation

-

Closed-Won/Lost

The real key is making sure each stage represents a genuine, verifiable milestone. If your stages are vague (I'm looking at you, "In Progress"), you have no idea where deals are actually stalling. Go too granular, and your reps will spend more time updating the CRM than actually selling. My advice? Start simple and let the data tell you when it's time to adjust.

What’s the Ideal Sales Pipeline Coverage Ratio?

The classic rule of thumb you’ll always hear is a 3x pipeline coverage ratio. This just means that if your quarterly revenue target is $100,000, you should have $300,000 worth of qualified opportunities bubbling away at the start of the quarter. It’s the sales equivalent of bringing way more snacks than you think you'll need on a road trip, better to have too much than not enough.

But hold on, this isn't a universal law. Your ideal ratio is all about your data. If your team has a killer win rate (say, 50%), you might only need a 2x ratio. On the flip side, if you have a low win rate (15%) and a long sales cycle, you might need 4x or even 5x coverage to sleep at night.

The only way to know for sure is to calculate it based on your own historical performance. The formula is beautifully simple: Pipeline Coverage = 1 / Your Historical Win Rate. So, for a 25% win rate, you'd need 1 / 0.25, which gives you 4x coverage.

How Often Should I Review My Sales Pipeline?

Consistency is king. A pipeline left to its own devices for weeks is a pipeline full of surprises, and trust me, they’re not the good kind.

Here’s a simple cadence that just plain works for most teams:

-

Daily (For the Reps): Every morning, reps should do a quick scan of their personal pipeline. It's the best way to prioritize their day's tasks and focus on what matters.

-

Weekly (For the Team): Sales managers need to run a dedicated pipeline review meeting. This isn't about grilling people; it's about strategizing on key deals, sniffing out risks, and offering coaching.

-

Monthly/Quarterly (For Leadership): The top brass should conduct a high-level review to spot trends, check forecast accuracy, and make sure the sales engine is humming along with the rest of the business.

That weekly team review? It’s arguably the most critical meeting you'll have for keeping deals moving and spotting problems before they completely derail your quarter.

What Are the Most Common Pipeline Leaks and How Do I Fix Them?

I see the biggest leaks in the same two spots, time and time again: the handoff from Marketing Qualified Lead (MQL) to Sales Qualified Lead (SQL), and the jump from the Proposal stage to Closed.

The MQL-to-SQL leak is almost always caused by a sloppy handoff process or a fundamental disconnect between what marketing thinks is a good lead and what sales actually needs. The fix is a rock-solid Service Level Agreement (SLA) that puts the definition of a qualified lead in writing. No more arguments.

That dreaded Proposal-to-Close leak? It usually happens when a deal loses steam or gets stuck with a single contact who suddenly goes dark. You can patch this by setting crystal-clear next steps in a mutual action plan and by multi-threading, which is getting multiple decision-makers at the account on your side. For a deeper look at optimizing these workflows, understanding what sales automation is can reveal some clever ways to keep deals chugging along without all the manual nagging.

Ready to stop guessing and start building a predictable revenue engine? Munch is the all-in-one platform that helps you find high-intent prospects, enrich their data, and launch personalized outreach that actually gets replies. Signup today and see how you can fill your pipeline with deals that are actually ready to close.